Lesotho’s Diamond Mine Cuts Workforce Amid Global Slump

A 20% layoff at the famed Letseng mine underscores Africa’s persistent vulnerability to commodity cycles and external shocks.

High in the Maluti mountains, Lesotho’s Letseng mine has long been a source of pride. Famous for producing some of the world’s largest diamonds, it has provided jobs, foreign exchange, and a rare global foothold for a tiny landlocked country. But this week, management announced the layoff of roughly 20 percent of its workforce, citing collapsing global demand.

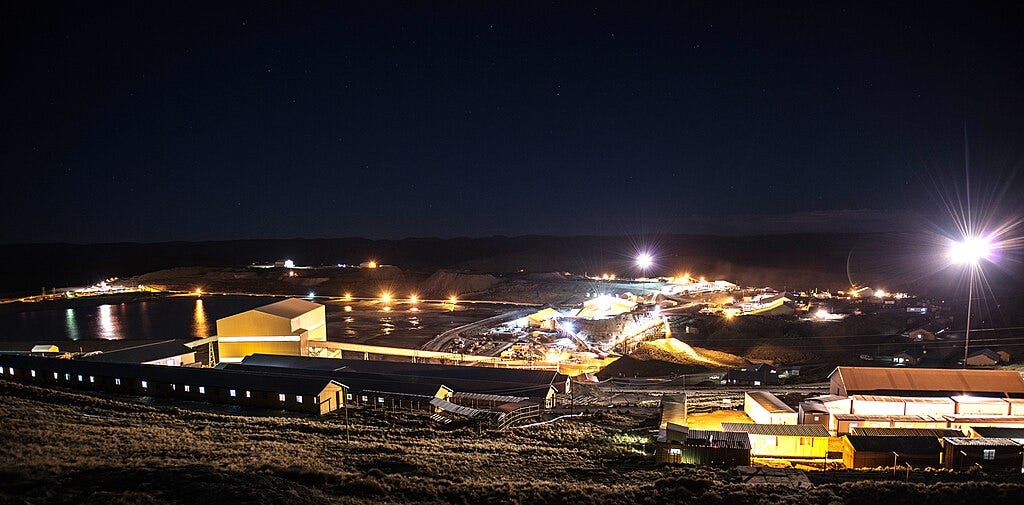

Image: Letšeng Diamond Mine in Lesotho, CC BY-SA 3.0

The news is grim for Lesotho but emblematic of a broader African dilemma. Many economies on the continent remain tethered to commodity cycles. When prices rise, governments enjoy windfalls; when they fall, the social and political costs are immediate. The 2008 financial crisis revealed this fragility. A decade later, the COVID-19 pandemic reinforced it. Now, a diamond slump underscores how dependent African states remain on global whims.

Economists have long urged diversification: agriculture, manufacturing, services. Yet structural barriers—weak infrastructure, limited capital, and entrenched patronage networks—make such transitions painfully slow. For resource-dependent states, downturns not only threaten growth but also risk political instability, as unemployed miners and disillusioned youth vent frustrations against fragile governments.

Our Take: Lesotho’s mine cuts are more than a local story. They are a reminder that Africa’s economic resilience still hinges on breaking free from commodity dependency. The thin red line here is between cyclical hardship and systemic fragility that can spill into political crisis.