Iran Maneuvers as Oil Sanctions Tighten, Looking Eastward

Sanctions push Iran’s “dark fleet” east, raising the risk that interdictions spill into kinetic conflict at sea.

Tighter U.S. sanctions on Iran’s covert oil exports have pushed Tehran deeper into workaround mode. The “dark fleet” now leans on AIS blackouts, ship-to-ship transfers, and blending schemes to reach primarily Asian buyers, especially China. Each layer of evasion raises not just legal risk but operational risk: more nighttime transfers, more uninsured voyages, more chance of collision or spill in congested lanes.

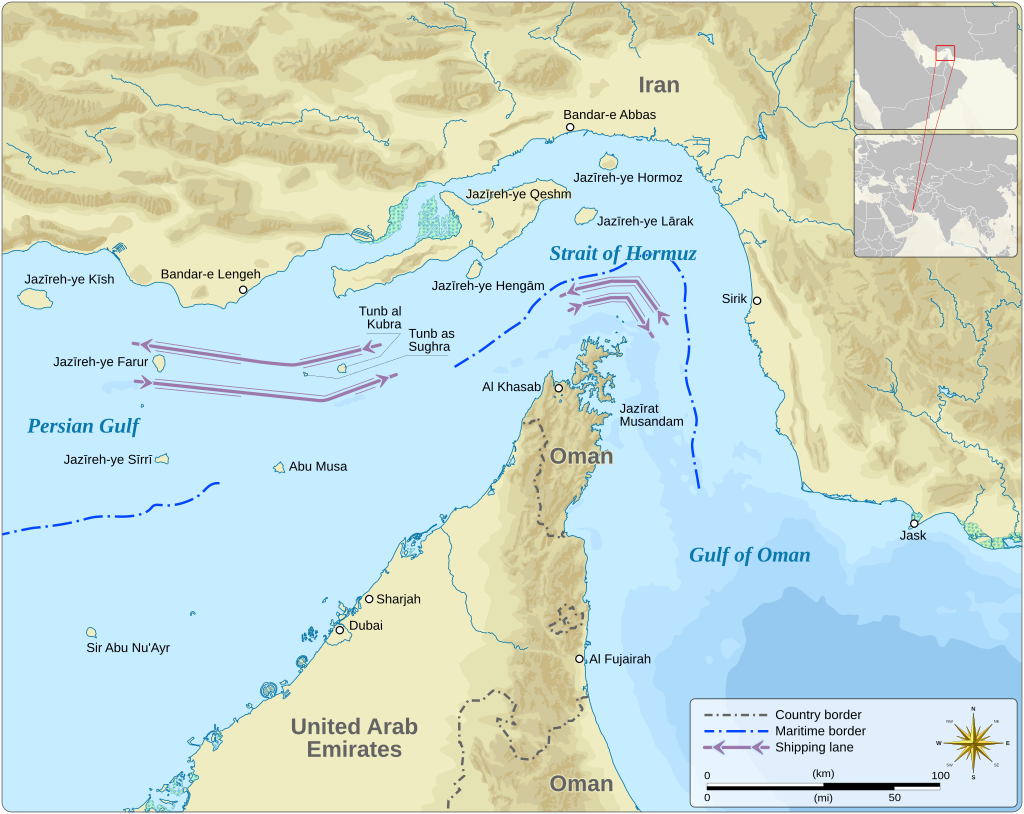

Image: “Strait of Hormuz (map)” by Goran tek-en, licensed under CC BY-SA 4.0

Gulf producers see a double-edged sword. Sanctions can buoy prices, but they also elevate maritime risk premia and invite miscalculation. Every interdiction at sea risks a retaliatory seizure, cyber strike, or rocket barrage—actions that can widen quickly and unpredictably. Meanwhile, geography grants Tehran leverage it never tires of signaling: the Strait of Hormuz remains one of the world’s most vital arteries, carrying roughly a fifth of global petroleum liquids.

Sanctions rarely force capitulation; they induce adaptation. Iran’s economy has grown more inventive at sanctions-time logistics, barter arrangements, and murky intermediaries. The United States, for its part, seeks a delicate balance—squeezing revenues while avoiding a direct collision that could upend energy markets on the eve of a slowing global cycle.

Our Take: The world’s sea lanes are the line. Each interdiction risks tipping economic warfare into kinetic confrontation.