The global semiconductor supply chain represents the most strategically vulnerable infrastructure in modern civilization. Taiwan Semiconductor Manufacturing Company produces over 90% of the world’s most advanced chips, yet sits 100 miles from a mainland that claims sovereignty over it. The Netherlands’ ASML holds a monopoly on extreme ultraviolet lithography machines—each costing $200 million and essential for cutting-edge production. Germany supplies the molecularly perfect mirrors these systems require. Japan dominates the chemical materials and ultra-pure silicon wafers. The United States designs the chips and creates the software tools that make fabrication possible. This archipelago of excellence spans rival powers and contested geographies. A single disruption—earthquake, embargo, invasion, or industrial accident—could cascade through the entire system, halting production of everything from smartphones to missile guidance systems within weeks.

The Strategic Context

The semiconductor industry embodies a paradox of 21st-century geopolitics: extreme interdependence among strategic rivals. Unlike petroleum, which flows from concentrated deposits through replaceable pipelines, advanced semiconductors require a manufacturing choreography that cannot be easily replicated or rerouted. The technology’s complexity creates chokepoints—ASML’s EUV monopoly, TSMC’s fabrication dominance, Japan’s chemical precision—that grant individual nations veto power over global digital infrastructure.

This differs fundamentally from Cold War-era strategic dependencies. Soviet oil could be replaced; Persian Gulf crude could flow through alternative routes. But there exists no substitute for an ASML EUV machine, no backup fabrication capacity matching TSMC’s 3-nanometer processes, no alternative source for the ultra-pure photoresists that Japanese firms have perfected over decades. The supply chain’s strength—its optimization through specialization—has become its fatal weakness.

The COVID-19 pandemic and Russia’s 2022 invasion of Ukraine demonstrated this fragility empirically. Automotive production ground to a halt worldwide not from factory closures but from chip shortages. When Ukrainian neon gas supplies were disrupted, semiconductor manufacturers scrambled to secure alternatives, revealing dependencies few industry executives had fully mapped. These were relatively minor disruptions. A conflict over Taiwan would be catastrophic.

Taiwan: The Irreplaceable Node

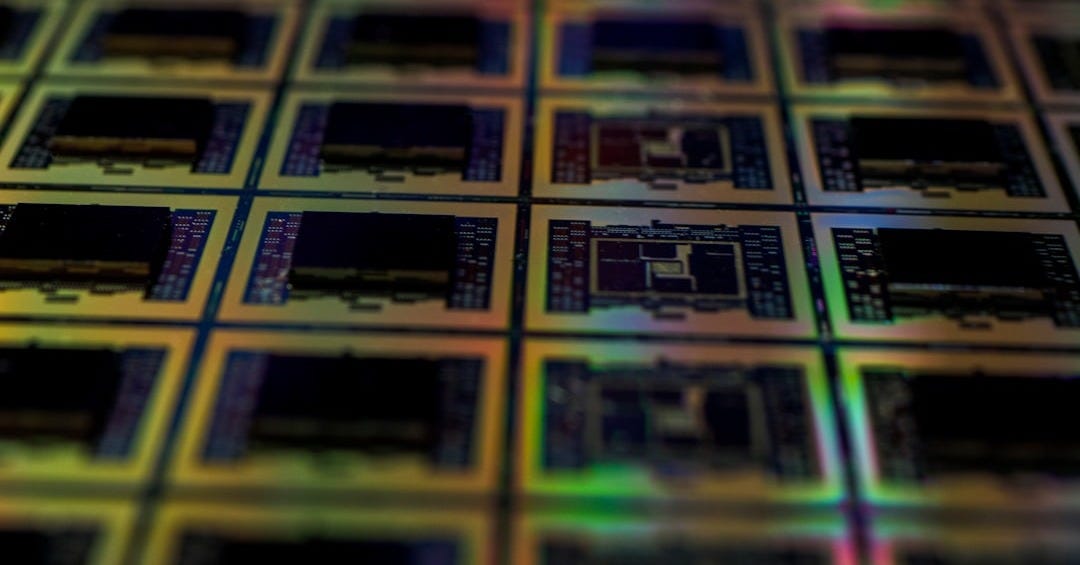

Taiwan Semiconductor Manufacturing Company operates 13 fabrication facilities across Taiwan, producing approximately 12,000 wafers per day at its most advanced nodes. The company manufactures chips for over 500 clients, including Apple, Nvidia, AMD, Qualcomm, and virtually every major technology firm globally. Its Fab 18 facility in Tainan, which began production in 2021, handles the world’s first high-volume 3-nanometer manufacturing—circuits with features smaller than most viruses.

The island’s geography compounds its strategic importance. Taiwan lies astride the first island chain that Pentagon planners view as essential to containing Chinese military power. The Taiwan Strait averages just 100 miles wide; Chinese fighter jets now regularly cross its median line. Beijing has never renounced the use of force to achieve reunification, and President Xi Jinping has described Taiwan’s integration as essential to national rejuvenation. The United States maintains strategic ambiguity about whether it would defend Taiwan militarily, even as it sells Taipei billions in advanced weaponry and maintains that any change in Taiwan’s status must be peaceful and consensual.

TSMC’s fabrication facilities concentrate in Hsinchu Science Park and the southern campuses near Tainan—both within range of Chinese precision-strike missiles. The company’s cleanrooms require stable power, ultra-pure water, and vibration-free environments. Even a brief interruption would contaminate wafer lots worth hundreds of millions of dollars. A extended disruption would halt the production of new iPhones, data center processors, automotive controllers, and military systems globally within three to six months as existing inventories depleted.

Washington and allies have recognized this vulnerability. The U.S. CHIPS and Science Act of 2022 allocated $52 billion to rebuild domestic semiconductor manufacturing. TSMC is constructing two fabrication facilities in Arizona—the first scheduled to begin 4-nanometer production in 2025, the second targeting 3-nanometer processes by 2026. But these represent a small fraction of TSMC’s total capacity and will require years to reach full production. Intel’s effort to restore American fabrication leadership through its IDM 2.0 strategy remains years behind TSMC’s process technology. Samsung’s advanced fabs in South Korea offer geographic diversity but not genuine redundancy—they serve different clients and produce different designs.

The uncomfortable reality is that Taiwan’s geopolitical vulnerability has become embedded in the architecture of global technology. Diversifying away would require a decade and hundreds of billions in investment, and even then would not fully replicate TSMC’s accumulated expertise.

The Netherlands and Germany: Monopolies of Precision

ASML Holding NV occupies a unique position in global industry: it is the sole manufacturer of extreme ultraviolet lithography systems capable of producing chips below 7 nanometers. The company delivered 39 EUV machines in 2023, each priced above $200 million and weighing 180 metric tons. These systems represent the pinnacle of precision engineering—they position silicon wafers to within a fraction of a nanometer while firing 50,000 pulses of light per second through optics that must remain atomically smooth.

The EUV process works by vaporizing tin droplets with a laser, creating plasma that emits extreme ultraviolet light at 13.5-nanometer wavelength. This light bounces off a series of multilayer mirrors—produced exclusively by Germany’s Carl Zeiss SMT—before reaching the silicon wafer. The mirrors’ surface roughness must not exceed 0.1 nanometers; scaled to the size of Germany, the largest imperfection would be less than a millimeter tall. Achieving this requires vacuum deposition of molybdenum and silicon layers, polished through processes Zeiss has refined over decades.

ASML’s machines also depend on components from across Europe and beyond: The laser source combines technology from San Diego-based Cymer (now owned by ASML) with industrial lasers from Germany’s TRUMPF. Specialized measuring equipment comes from Zeiss and other German firms. The mechanical stages that move wafers use granites quarried in specific locations and aged for years to achieve thermal stability. Final assembly occurs at ASML’s Veldhoven campus in the Netherlands, where clean rooms larger than aircraft hangars allow technicians to integrate thousands of components into functioning systems.

This European monopoly emerged not from explicit industrial policy but from decades of cumulative specialization. ASML survived multiple near-bankruptcy moments in the 1990s, persisting when rivals like Nikon and Canon focused on incrementally improving older lithography technologies. The decision to pursue EUV—a technology many experts deemed commercially impossible—required patience from Dutch and European investors willing to accept losses for over a decade before the technology matured.

Today, this specialization grants significant geopolitical leverage. In 2019, under American pressure, the Netherlands blocked ASML from selling EUV systems to China—a decision that has limited Chinese semiconductor advancement more effectively than any tariff. China’s Semiconductor Manufacturing International Corporation (SMIC) remains stuck at 7-nanometer production using older deep ultraviolet (DUV) lithography, requiring multiple exposures and achieving lower yields than TSMC’s 3-nanometer EUV processes. Without access to EUV, Chinese fabs cannot match the performance, power efficiency, or economic viability of leading-edge chips.

This export control regime demonstrates how technical monopolies translate to strategic power. ASML’s machines have become a bargaining chip in U.S.-China technology competition, even though the company is European and depends on global supply chains itself. The Netherlands must balance its economic interests—China represented a significant market for ASML’s older DUV systems—against alliance pressures from Washington. Germany faces similar tensions, as its optical and mechanical components enable ASML’s monopoly but also expose German firms to geopolitical crosswinds.

The United States: Design Dominance and EDA Tools

American semiconductor companies no longer manufacture most chips, but they design nearly all the advanced ones. Nvidia’s graphics processing units power artificial intelligence training; Apple’s custom silicon enables the performance and battery life of iPhones and MacBooks; AMD and Intel architect the processors running data centers and personal computers globally. These firms employ thousands of engineers who create chip architectures, optimize transistor layouts, and verify designs through millions of simulation hours before committing patterns to silicon.

This design work depends on a specialized software ecosystem: electronic design automation (EDA) tools provided primarily by three American companies. Synopsys, Cadence Design Systems, and Siemens (which acquired Mentor Graphics) supply the software that allows engineers to create nanometer-scale circuits without hand-drawing every transistor. Their tools simulate electrical behavior, verify that designs meet specifications, and generate the photomask patterns that lithography machines will print onto wafers. Without EDA software, modern chip design would be practically impossible—the number of transistors in advanced processors (tens of billions) exceeds what any team could design manually.

These companies maintain their dominance through decades of accumulated intellectual property and tight integration with semiconductor manufacturers. As TSMC develops new fabrication processes, Synopsys and Cadence update their tools to model the new materials and structures, creating a feedback loop that privileges firms with access to this ecosystem. Chinese EDA companies have made progress but remain generations behind in capability, particularly for the most advanced nodes.

The United States also supplies critical hardware for lithography. Cymer, headquartered in San Diego before its acquisition by ASML, developed the laser-produced plasma source that generates EUV light. The system uses carbon dioxide lasers supplied by Germany’s TRUMPF to blast tin droplets, but the overall architecture originated from American research. This represents a strategic chokepoint: even if China could build its own lithography machines, replicating the plasma source would require solving materials science and engineering challenges that took Cymer decades to master.

American universities and national laboratories also provide foundational research. Many breakthroughs in transistor design, materials science, and fabrication processes originate in U.S. academic institutions, often funded by the Department of Defense, the National Science Foundation, or public-private partnerships. This research base feeds both American companies and foreign partners, but it also means disrupting academic exchange or technology transfer would ripple through the entire innovation ecosystem.

The CHIPS and Science Act attempts to rebuild American manufacturing capacity while maintaining these design advantages. The law provides $39 billion in direct subsidies for fabrication facilities, plus 25% tax credits for semiconductor manufacturing equipment. Intel received $8.5 billion to construct fabs in Arizona, Ohio, New Mexico, and Oregon. TSMC secured $6.6 billion for its Arizona facilities; Samsung received $6.4 billion for a Texas plant expansion. These investments aim to produce at least 20% of the world’s leading-edge chips in the United States by 2030.

But subsidies cannot instantly recreate industrial ecosystems. Semiconductor fabs require specialized construction techniques—vibration isolation, ultra-clean environments, chemical delivery systems—plus trained technicians, equipment engineers, and process specialists. Taiwan and South Korea have developed these capabilities over 30 years; American efforts are essentially starting fresh. The Arizona TSMC fab has faced delays from permitting issues, construction labor shortages, and difficulties recruiting technicians with fabrication experience. Even with billions in subsidies, replicating Taiwan’s semiconductor cluster may prove impossible without also replicating its educational system, labor practices, and supplier networks.

Japan: Chemical Precision and Material Science

Japan manufactures approximately 90% of the world’s photoresists—light-sensitive polymers that pattern chips during lithography. Companies like Tokyo Ohka Kogyo (TOK), JSR Corporation, and Sumitomo Chemical have perfected formulations that respond uniformly to nanometer-wavelength light while maintaining atomic-level sharpness. A single batch of photoresist may contain dozens of components, each purified to parts-per-trillion contamination levels. The slightest impurity creates defects; the wrong viscosity causes uneven coating; improper light sensitivity blurs circuit patterns.

Shin-Etsu Chemical and SUMCO Corporation dominate production of silicon wafers—the circular substrates on which chips are built. Manufacturing these requires growing single crystals of silicon from molten seed crystals, a process called Czochralski growth. The resulting ingots, sometimes weighing hundreds of kilograms, must have near-perfect crystal structure. They are sliced into wafers 300 millimeters in diameter and less than a millimeter thick, then polished until their surfaces vary by less than a nanometer. Any deviation creates electrical irregularities that render chips unusable.

Japan also supplies specialty gases essential to fabrication: ultra-high-purity nitrogen, fluorine compounds, and nitrogen trifluoride for chamber cleaning. These gases must be manufactured and transported under rigid specifications—trace moisture, oxygen, or particle contamination can ruin entire production runs. Japanese gas suppliers have built reputation and infrastructure for reliability that few competitors can match.

This dominance emerged from Japan’s industrial culture of incremental perfection. While Japanese electronics firms like Toshiba, NEC, and Hitachi ceded leadership in chip design and fabrication during the 1990s, the country’s materials and equipment suppliers maintained market position through continuous quality improvement. They benefit from close relationships with domestic customers, long-term employment practices that retain expertise, and manufacturing disciplines honed through decades of exports.

The strategic implications are significant. South Korea attempted to develop independent photoresist supplies after Japan restricted exports in 2019 following diplomatic disputes over wartime labor compensation. Despite government subsidies and crash programs, South Korean firms could not quickly replicate Japanese chemical formulations. Samsung and SK Hynix were forced to draw down inventories and seek export permits from Tokyo, demonstrating that even advanced industrial economies cannot easily substitute specialized materials.

Japan’s position also complicates geopolitical scenarios. In a Taiwan crisis, Japan would face pressure to restrict chemical exports to Chinese fabs while maintaining supplies to TSMC and other allied manufacturers. Tokyo has strengthened export controls on semiconductor materials as part of coordination with Washington, but outright embargoes would damage Japanese firms and potentially push China to accelerate its own materials development. Japan must balance alliance commitments, commercial interests, and the risk that overly aggressive restrictions might backfire by incentivizing competitors.

Global Raw Materials: The Extractive Foundation

Every semiconductor begins as sand—specifically, ultra-high-purity quartz mined from a single region: Spruce Pine, North Carolina. The crystalline structure of this quartz allows it to be refined into polysilicon with fewer impurities than material from other sources. A single atomic contaminant in a billion can create electrical defects; Spruce Pine quartz comes closest to the purity required for advanced chips. The mines are privately owned; their output is essential to global semiconductor production.

Silicon is then combined with dopants—elements that alter electrical properties. Boron and phosphorus are common, but advanced chips use arsenides, gallium, germanium, and rare-earth elements. These materials come from global supply chains with varying degrees of concentration:

Copper: Chile dominates production, providing roughly 25% of global supply from mines concentrated in the Atacama Desert. China refines the largest share of copper globally. Chips use copper for interconnects—the wiring between transistors—because of its superior electrical conductivity compared to aluminum.

Cobalt: Approximately 70% of global cobalt comes from the Democratic Republic of Congo, much of it from small-scale mines with serious human rights and environmental concerns. Cobalt is used in some chip packaging and battery technologies. Supply chains have faced scrutiny from regulators and activists, though semiconductor use represents a small fraction of total cobalt demand compared to electric vehicles.

Rare earth elements: China processes over 85% of global rare earths, even for ores mined elsewhere. These elements—including neodymium, dysprosium, and yttrium—appear in specialized semiconductors, lasers, and the magnetic components of chip manufacturing equipment. Beijing has repeatedly suggested restricting rare earth exports as economic leverage, though it has not implemented comprehensive bans.

Neon and other noble gases: Ukraine and Russia together supplied approximately 50% of global semiconductor-grade neon before February 2022. Neon is used in the lasers for older DUV lithography systems. Russia’s invasion disrupted supplies, forcing chipmakers to qualify alternative sources in Romania and China. The episode revealed how geopolitical conflicts in seemingly unrelated regions could cascade into semiconductor shortages.

Gallium and germanium: China announced export controls on these materials in July 2023, escalating technology competition with the United States. Gallium nitride enables high-frequency semiconductors used in military radar and satellite communications; germanium appears in infrared sensors and fiber optics. While alternative sources exist, China’s refining dominance means restrictions create immediate supply pressures.

This extractive foundation ties semiconductor production to some of the most geopolitically unstable regions on Earth: Congo’s mineral-rich but war-torn east, Chile’s water-stressed northern deserts, China’s rare earth monopolies. It also creates environmental dependencies—silicon wafer production requires vast quantities of ultra-pure water; chemical manufacturing generates toxic waste streams; mining operations scar landscapes and displace communities. The semiconductor industry’s clean-room glamour obscures an industrial base rooted in nineteenth-century extraction industries.

Strategic Options and Constraints

Governments worldwide have recognized semiconductor dependence as a national security vulnerability. The United States, European Union, China, Japan, South Korea, and India have all announced major initiatives to build domestic capacity. But several structural constraints limit what policy can achieve:

Technical barriers: Advanced semiconductor manufacturing represents possibly the most complex industrial process humans have created. It requires integrating thousands of steps, each with nanometer tolerances, in environments cleaner than hospital operating rooms. Even with unlimited funding, building expertise takes years. Morris Chang, TSMC’s founder, has said the company’s advantage lies not in any single technology but in accumulated knowledge of how to manufacture reliably at high volumes—a capability that cannot be purchased or legislated.

Scale economics: Fabrication facilities cost $15-20 billion to construct and require constant upgrades to remain competitive. Only companies producing at enormous scale can amortize these costs. Intel’s difficulties competing with TSMC stem partly from having fewer customers to spread fab expenses across. This creates a natural tendency toward concentration—unless governments subsidize inefficiency, only a few firms can justify the investment.

Supply chain interdependence: Even if the United States successfully produces advanced chips domestically, those chips will still require photoresists from Japan, equipment from the Netherlands, and materials from dozens of countries. True supply chain independence would mean replicating the entire global ecosystem—a multi-trillion-dollar proposition that would sacrifice the efficiencies specialization provides. Some diversification is possible; complete self-sufficiency is not.

Time horizons: The CHIPS Act fabs will take 5-10 years to reach full production. China’s semiconductor initiatives have similar timelines. But geopolitical crises—a Taiwan contingency, for example—could occur before new capacity comes online. Short-term vulnerabilities remain acute even as medium-term diversification proceeds.

Talent constraints: Semiconductor engineering requires specialized education—materials science, electrical engineering, chemical engineering, industrial engineering—plus hands-on fabrication experience. The United States graduates fewer engineers in these fields than East Asian countries, and fewer still pursue careers in manufacturing versus software development. Industry executives report that workforce limitations constrain expansion as much as capital.

China faces distinct challenges in its pursuit of semiconductor self-sufficiency. Without access to ASML’s EUV machines, Chinese fabs cannot manufacture the most advanced chips. SMIC has achieved 7-nanometer production using older DUV technology and sophisticated multi-patterning techniques, but at lower yields and higher costs than TSMC’s EUV processes. Chinese firms have announced plans to develop domestic lithography equipment, but replicating ASML’s technology requires solving optics, laser, materials science, and precision mechanical engineering challenges simultaneously—a decades-long endeavor even with unlimited resources.

Export controls have emerged as Washington’s primary tool for maintaining technological advantage. The October 2022 export restrictions limit China’s access to advanced chips, chipmaking equipment, and EDA software. They also restrict American and allied nationals from supporting Chinese semiconductor development. These controls aim to freeze China’s capabilities several generations behind the leading edge, preventing Beijing from accessing the computing power needed for advanced AI systems and military applications.

But export controls create friction with allies. South Korean firms Samsung and SK Hynix manufacture memory chips in China and faced potential disruption from the restrictions. The Netherlands debated internally before agreeing to limit ASML’s EUV sales, and continues to face Chinese pressure to relax controls on older DUV systems. Japan implemented parallel export restrictions but must balance them against commercial relationships. The more expansive U.S. controls become, the more difficult allied coordination grows.

Our Take: The semiconductor supply chain is the central infrastructure vulnerability of our era. Unlike previous strategic dependencies—Persian Gulf oil, rare earth minerals, overseas manufacturing—this one cannot be quickly substituted or routed around. The world has built a prosperity machine that depends on the peaceful cooperation of strategic rivals and the continued stability of a contested island. Washington’s subsidies and export controls, Beijing’s industrial investments, and allied coordination efforts all represent attempts to escape this trap, but none can succeed quickly enough to eliminate near-term risks. The next decade will reveal whether interdependence proves robust enough to deter conflict or fragile enough to cause it. The uncomfortable truth is that the same specialization that enabled humanity’s digital revolution has created a global system where a single earthquake, embargo, or invasion could cascade into economic catastrophe. We have built our most advanced technologies on the most precarious of foundations.