The World on Edge

From Washington’s paradoxical allure to Europe’s troop debate, the Red Sea’s new battlefield, Africa’s solar gamble, and a fraying Quad—the thresholds of global order are being tested all at once.

Americas – Why Foreign Investors Still Flock to a Struggling U.S.—Despite the Warnings

The United States presents a paradox. By nearly every conventional metric, warning lights are flashing. Federal debt has surged to more than 120 percent of GDP, surpassing levels not seen since World War II. Inflation, though moderating from its 2022 peak, continues to unsettle markets. And political polarization has eroded confidence in Washington’s ability to govern, with repeated brinkmanship over the debt ceiling shaking the foundations of fiscal credibility.

And yet—foreign investors continue to buy U.S. assets at record levels. The latest Treasury data shows that overseas holdings of American debt and equities have not only held steady but grown, even during moments of domestic turmoil. Why?

The first answer is structural: the dollar’s unrivaled status as the world’s reserve currency. In every modern crisis—from the 2008 financial collapse to the COVID-19 pandemic—capital has flowed into U.S. treasuries. Liquidity and market depth remain unmatched, creating a gravitational pull for investors who may complain about dysfunction but have nowhere else to go.

The second answer lies in America’s enduring role as a hub of innovation. From artificial intelligence to biotech to clean energy, the United States continues to attract disproportionate global capital into its technology sector. Venture funds in Silicon Valley and Boston remain magnets for sovereign wealth funds from Asia and the Gulf, who see long-term value beyond short-term volatility.

But there is also a psychological dimension. Investors constantly weigh alternatives—and find them wanting. Europe remains mired in stagnation, China is struggling with demographic decline and debt, and emerging markets remain vulnerable to capital flight. The United States may appear turbulent, but against this backdrop, it still looks like the safest harbor in a storm.

And yet the paradox cannot endure forever. A genuine default triggered by political dysfunction could shatter trust overnight. Likewise, growing efforts at de-dollarization—from China’s push for yuan settlements to Gulf states experimenting with non-dollar oil trade—could gradually chip away at America’s financial hegemony.

Our Take: For now, the U.S. remains the world’s indispensable market. But the more the global economy leans on this single pillar, the greater the shock when cracks inevitably appear.

Europe – Is Europe Ready to Send Troops to Ukraine? Plans Are Now ‘Precise’—And Real

For nearly two years, Europe’s red line seemed clear: weapons, money, intelligence—yes. Boots on the ground—absolutely not. But today, that firewall is eroding. In Paris, Warsaw, and the Baltic capitals, officials are speaking openly of “precise scenarios” for troop involvement. French President Emmanuel Macron recently said he would not rule out future deployments. Polish leaders have hinted they might act unilaterally if Ukraine were on the verge of collapse.

Why now? The battlefield arithmetic has shifted. Russian forces are regaining ground in the Donbas. Ukrainian manpower is stretched thin, while U.S. military aid has slowed amid Washington’s partisan gridlock. For Europe, the nightmare is a Russian breakthrough that redraws Europe’s map and undermines the credibility of NATO’s eastern flank.

Yet divisions remain profound. Germany, haunted by its 20th-century history and constrained by fragile domestic coalitions, firmly opposes direct deployments. Italy and Spain, preoccupied with economic strain and migration, are wary of escalation. And within NATO, Washington continues to draw a bright line: any allied “boots on the ground” risk direct confrontation with Moscow.

Still, the mere fact of the debate is extraordinary. For decades, Europe leaned on U.S. leadership for hard power. Now, out of necessity, it is contemplating its own. The conversation signals that the war in Ukraine has become an existential European question, not just a transatlantic one.

The risks are immense. Limited troop roles—such as training, logistics, or air defense—could blur quickly into combat. Moscow has already warned that any NATO soldier in Ukraine would be treated as a legitimate target.

Our Take: The line between support and intervention is narrowing. If Europe sends troops—even in modest roles—it may find itself stumbling into direct war with Russia.

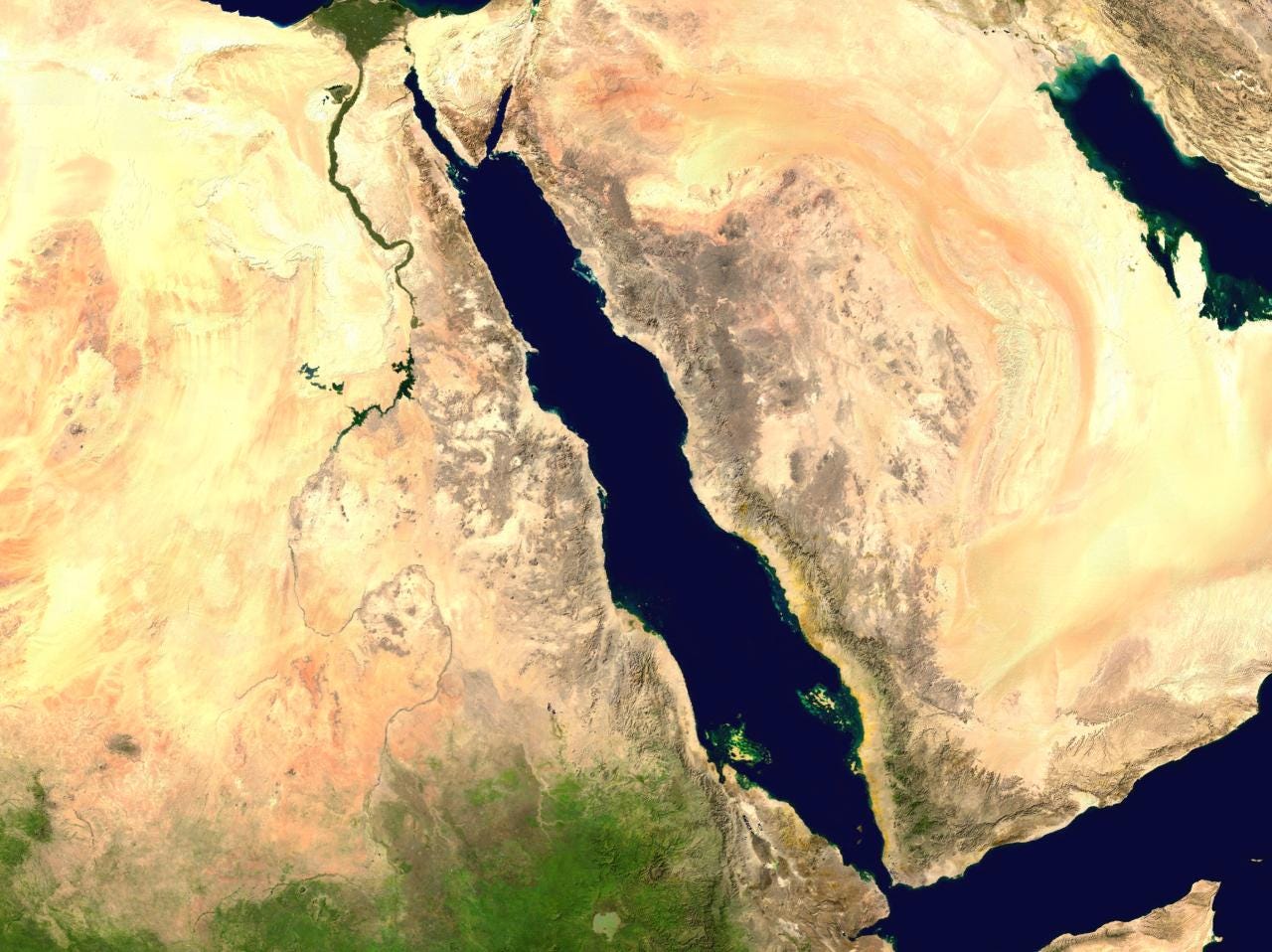

Middle East – Houthi Response to Israeli Strike: Rebellion Spills into the Red Sea and UN Halls

The conflict in Gaza has spawned new and unpredictable fronts. Israel’s recent strike on Houthi targets in Yemen—its first such action—has provoked fierce retaliation. The Houthis, long aligned with Iran, have declared the Red Sea a “zone of resistance.” Already, major shipping firms are rerouting vessels, and insurance costs for the Suez passage have soared.

The Houthis are no longer a parochial Yemeni insurgency. They now function as a regional proxy for Tehran. Their missile and drone strikes on Saudi Arabia and the UAE, their grip on Yemen’s key ports, and their new symbolic confrontation with Israel elevate them within the so-called “Axis of Resistance.” In New York, Yemeni representatives sympathetic to the Houthis demanded recognition at the UN, turning a once-local rebellion into a geopolitical flashpoint.

For Israel, the calculation is perilous. It sees the Houthis as part of Iran’s encirclement strategy—stretching from Hezbollah in Lebanon to Shiite militias in Iraq. By striking in Yemen, Israel aims to disrupt that chain. But it also risks widening its war into yet another front, alienating international partners and inviting accusations of overreach.

The Red Sea is one of the world’s oldest commercial arteries, carrying roughly 12 percent of global trade. Each escalation threatens to transform it from a trade corridor into a war zone—with consequences far beyond the Middle East.

Our Take: The Red Sea is no longer just a shipping lane—it is a battlefield. Each strike raises the risk that a regional insurgency morphs into a global maritime crisis.

Africa – Africa Turns to Solar—Despite Lagging Infrastructure, Demand Soars

Image: Installing solar panel, photo by Mulavu123 (Zimbabwe), CC BY-SA 4.0

Africa’s future may be powered by the sun. Across the continent, solar energy is spreading rapidly—from large-scale projects in Morocco and Egypt to household panels in Nigeria and Kenya. The drivers are clear: electricity demand is soaring, fueled by population growth, rapid urbanization, and an expanding middle class. Yet traditional power grids remain weak, plagued by chronic underinvestment, corruption, and rolling blackouts. Solar offers a pragmatic escape.

Foreign capital is pouring in. China has built some of Africa’s largest solar farms, while European firms see the continent as a testing ground for green technology. Morocco’s Noor Ouarzazate project, one of the largest solar complexes in the world, aims not only to supply domestic power but also to export electricity across the Mediterranean. Meanwhile, decentralized solutions are proliferating. “Pay-as-you-go” solar kits—cheap panels financed through mobile payments—are transforming rural villages, allowing households to leapfrog directly into the energy era.

Still, obstacles are formidable. Energy storage remains inadequate, grid integration is patchy, and financing skews toward urban elites. Most critically, solar alone cannot meet the heavy industrial demand Africa needs for sustained economic growth. Without complementary investment in transmission lines and regulatory reform, the solar boom could stall.

And yet momentum is undeniable. The International Energy Agency forecasts that Africa could generate nearly one-fifth of its power from renewables by 2040. If realized, this would reshape global energy flows and position Africa as both a consumer and exporter of clean energy.

Our Take: If Africa’s solar surge succeeds, it could alter the global energy order. But without infrastructure and governance reform, the continent risks deepening dependency on foreign powers for its green transition.

Asia-Pacific – Quad in Flux: Australia Watches as Trump–Modi Rift Deepens

Image: A PLAN Shenyang J-15 taking off from Liaoning, photo by Government of Japan / Joint Staff Office, CC BY 4.0

The Quad—an informal grouping of the U.S., India, Japan, and Australia—was once hailed as the Indo-Pacific’s strategic answer to China. Today, it looks less certain. The reemergence of Donald Trump on the U.S. political stage has unsettled India, as Trump has revived complaints about New Delhi’s “unfair trade practices” and questioned India’s reliability as a defense partner.

For Australia, this is deeply troubling. Canberra has invested heavily in the Quad as a hedge against China’s growing assertiveness, from the South China Sea to the Taiwan Strait. Japan, too, has sought to steady the grouping, urging focus on shared interests such as maritime security and supply chain resilience. But the bonds are fraying.

The Indo-Pacific cannot afford drift. China is more aggressive than ever: its navy is now the world’s largest by ship count, and its military activity near Taiwan intensifies almost weekly. Without a cohesive Quad, smaller states may hedge, striking bilateral deals with Beijing or adopting a posture of quiet accommodation.

Australia finds itself particularly exposed. Its economy remains tied to China even as its security relies on the U.S. Canberra has cultivated close defense ties with India, but if U.S.-India relations sour, it risks being forced into impossible choices. For now, Australia waits, hoping politics in Washington and Delhi stabilize before years of coalition-building unravel.

Our Take: The Quad was designed as a bulwark against Chinese dominance. If it fractures, the Indo-Pacific balance could tilt decisively in Beijing’s favor.