Weaponized Chokepoints, Tested Credibility

Sanctions rattle tankers, NATO signals steel, Iran’s dark fleet adapts, Africa strains under higher yields, and Beijing flaunts unity—the thin red lines now run through sea lanes and bond markets.

Americas — U.S. Sanctions Shake Oil Markets, Exposing Fragile Energy Balances

Washington has slapped new penalties on a shipping web accused of masking Iranian crude as Iraqi oil—an elaborate blending and paper trail operation that’s flourished in the gray zones of maritime trade. Markets did what they always do with sanctions: they zigged and zagged. Prices dipped on execution jitters, then rebounded and held near a one-month high as traders reassessed supply risk. The message was unmistakable: in a world of tight spare capacity and stretched logistics, the mere threat of enforcement can move barrels and budgets.

The United States still acts as the chief referee of seaborne energy flows, targeting not only state entities but the intermediaries—traders, tanker owners, and facilitators—who enable shadow cargoes. Yet enforcement is a game of inches. It relies on AIS pings, port state cooperation, insurers’ risk tolerance, and the diligence of banks and brokers in opaque jurisdictions. One disguised cargo slipping through can dull the bite; a single high-profile seizure can sharpen it again. Volatility, not directionality, is the near-term result.

Across the hemisphere, that volatility lands unevenly. Venezuela, clinging to a fragile stabilization, welcomes any price support but fears whipsaw swings that can scramble domestic fuel supplies. Brazil, now a heavyweight exporter, spies market share wins if marginal barrels are sidelined—but knows refinery margins and consumer prices can turn political quickly. Mexico sits in the awkward middle: oil producer, fuel importer, and fiscal planner whose budget math depends on where crude and gasoline settle, not just where they trade intraday.

History is prologue. From the Suez crisis to the 1980s tanker wars, energy leverage has never just been about chokepoints; it’s about systems: ships, insurers, financiers, and norms. Today’s chokepoint is the global tanker fleet itself—and the increasingly sophisticated networks that obscure origin and destination.

Our Take: The red line is the integrity of maritime oil flows. Once chokepoints are weaponized, the boundary between enforcement and escalation thins dangerously.

Europe — Trump Reassures Poland, Sends Stark Warning to Putin

Standing with newly elected Polish President Karol Nawrocki at the White House, President Trump pledged to keep U.S. troops in Poland—and hinted at more to come. His formulation—if Moscow miscalculates, “you’ll see things happen”—was meant for the Kremlin, but it echoed through Europe’s chancelleries. Warsaw heard reassurance; elsewhere, the question was credibility. Rhetoric matters, but in NATO it is deployments, exercises, and budgets that sustain deterrence.

Image: “Poland–Belarus border in Białowieża Forest” by Fallaner, licensed under CC BY-SA 4.0

Poland has done its part, lifting defense outlays well above most allies as a share of GDP and racing to field air and missile defenses, armor, and artillery. Even so, Warsaw’s shield is tethered to American politics and American fiscal capacity. Across the Channel and across the Rhine, long-dated borrowing costs have climbed, forcing hard trade-offs between guns and everything else. Europe learned in the Cold War that deterrence is a habit, not a statement; it requires constant renewal.

The strategic dilemma is straightforward: credible forward presence draws a clear line on NATO’s eastern frontier, deterring incremental probes. But credibility erodes if promises drift from practice or if budgets buckle under higher debt-service costs. Words buy time; only resources buy insurance.

Our Take: NATO’s eastern frontier is a living boundary. It holds only if commitments are matched by consistent action—and the financing to sustain it.

Middle East — Iran Maneuvers as Oil Sanctions Tighten, Looking Eastward

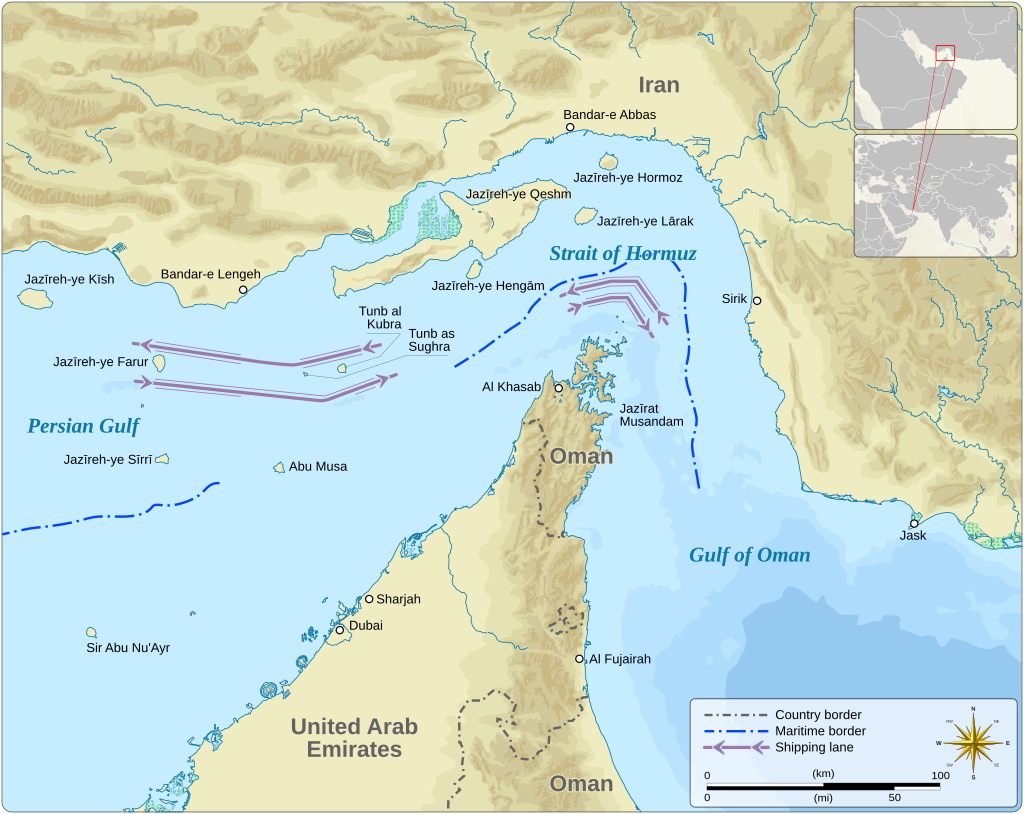

Tighter U.S. sanctions on Iran’s covert oil exports have pushed Tehran deeper into workaround mode. The “dark fleet” now leans on AIS blackouts, ship-to-ship transfers, and blending schemes to reach primarily Asian buyers, especially China. Each layer of evasion raises not just legal risk but operational risk: more nighttime transfers, more uninsured voyages, more chance of collision or spill in congested lanes.

Image: “Strait of Hormuz (map)” by Goran tek-en, licensed under CC BY-SA 4.0

Gulf producers see a double-edged sword. Sanctions can buoy prices, but they also elevate maritime risk premia and invite miscalculation. Every interdiction at sea risks a retaliatory seizure, cyber strike, or rocket barrage—actions that can widen quickly and unpredictably. Meanwhile, geography grants Tehran leverage it never tires of signaling: the Strait of Hormuz remains one of the world’s most vital arteries, carrying roughly a fifth of global petroleum liquids.

Sanctions rarely force capitulation; they induce adaptation. Iran’s economy has grown more inventive at sanctions-time logistics, barter arrangements, and murky intermediaries. The United States, for its part, seeks a delicate balance—squeezing revenues while avoiding a direct collision that could upend energy markets on the eve of a slowing global cycle.

Our Take: The world’s sea lanes are the line. Each interdiction risks tipping economic warfare into kinetic confrontation.

Africa — Commodity Crunch Tests African Exporters Amid Global Market Shocks

Rising global yields are rippling through African balance sheets. When U.S. Treasuries sell off, financing costs jump across the emerging world—just as growth wobbles and terms of trade swing. For oil exporters like Nigeria and Angola, revenue depends as much on stability as on headline prices. A price dip or a shipping scare can blow a hole in budgets and pressure currencies.

Image: “Accra, Ghana” by Amanor kwaku, licensed under CC BY-SA 4.0

For non-oil borrowers—Ghana, Kenya, South Africa—the strain is different but no less acute. Refinancing walls loom. Investors rotate back into “safe” assets. Margins on infrastructure loans widen. Politically, higher debt service squeezes social spending and makes subsidy reform harder to sell. The memories of 2007–08, when food and fuel spikes triggered unrest, remain fresh.

There are bright spots. Several governments have pushed through restructurings and IMF programs, clearing arrears and restoring a path to market access. But resilience is conditional. If the global cost of money keeps ratcheting higher, more sovereigns will be forced back to the table, and growth plans will be rewritten yet again.

Our Take: Debt sustainability is the threshold. When benchmark yields jump abroad, defaults and disorder at home become more likely.

Asia-Pacific — Beijing’s Victory Day Parade Flaunts an Axis of Authoritarians

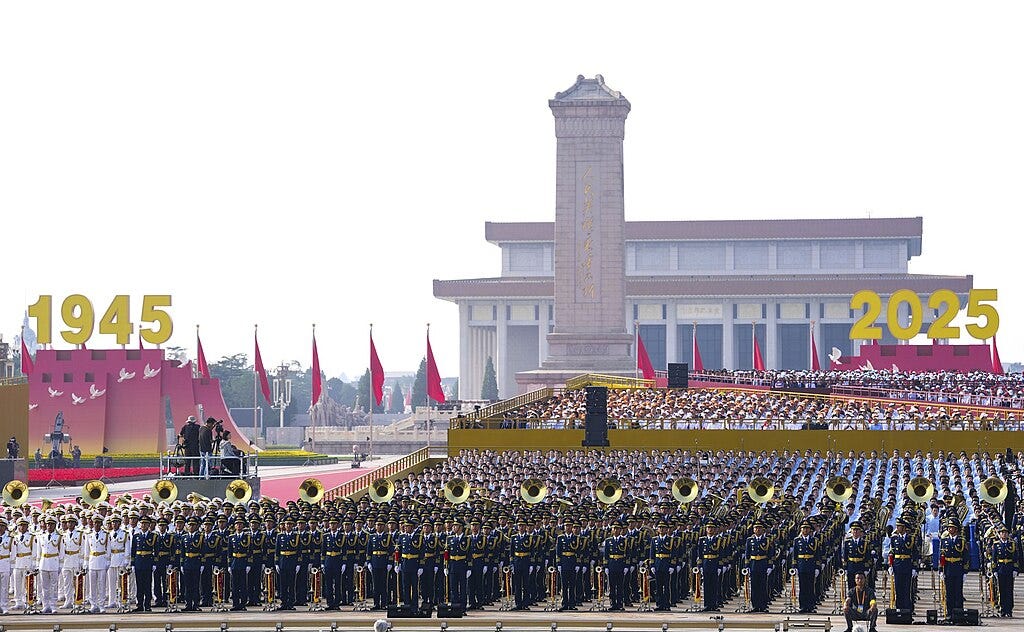

On the 80th anniversary of Japan’s surrender, Beijing staged a massive military parade through Tiananmen—an unmistakable display of power and messaging. The hardware was eye-catching: hypersonic and nuclear-capable missiles, advanced drones, and high-tech command units. The optics were sharper still: Vladimir Putin and Kim Jong Un flanking Xi Jinping, a tableau of convergence among U.S. adversaries.

Image: “2025 China Victory Day Parade” by President of Russia (Kremlin.ru), licensed under CC BY 4.0

The symbolism is deliberate. China frames the spectacle as historical remembrance and national rejuvenation; the deeper signal is geopolitical—a challenge to the U.S.-led order and a claim to leadership of a different one. Yet this axis is brittle beneath the banners. China wrestles with a slowing economy and demographic headwinds. Russia is mired in an expensive war. North Korea depends on illicit trade and patronage. Alignment born of grievance is powerful, but often temporary.

History counsels caution. Khrushchev’s parades projected power beyond reality—and sometimes lulled the West into either overreaction or complacency. The question now is whether Beijing, Moscow, and Pyongyang can translate spectacle into sustained coordination, or whether fissures widen as interests diverge. Either way, Asia’s security architecture is being contested in full view.

Our Take: Asia’s security order is the contested line. The show of unity masks structural fragilities that could turn solidarity into liability.